Bitcoin Halving 2024 is the most awaited occurrence in the crypto world. With the day drawing close, most people in the cryptocurrency community are anxious to know what will happen. But what exactly is Bitcoin halving and what does it mean for its future?

This article aims to explore the coin’s halving mechanics, its effects on the economy, and how it can change the entire cryptocurrency ecosystem.

Understanding Bitcoin Halving 2024

Bitcoin halving is a predetermined event that takes about every 4 years, or every 210,000 blocks that are mined. In such a case, the reward miners get for putting new transactions into the blockchain decreases by half.

This event has significant effects on the whole cryptocurrency market along with miners. When Bitcoin first launched in 2009, Satoshi Nakamoto offered 50 BTC as a reward for every block mined.

In 2012, the first halving reduced this reward to 25 BTC; another halving happened in 2016 bringing it down to 12.5 BTC. The latest halving that occurred in 2020 lowered it even further to 6.25 BTC.

In October 2024, the Bitcoin Halving will cut the reward to 3.125 BTC per block, making mining Bitcoin increasingly complex and less profitable over time.

The Economic Impact of Bitcoin Halving 2024 on Cryptocurrency

The major objectives of the Bitcoin halving are to keep up the scarcity and control inflation. Halving helps keep Bitcoin’s value stable by limiting the number of new coins added to circulation, especially since there’s a total cap of 21 million coins.

Supply and Demand Dynamics of Bitcoin Halving 2024

A key economic effect of the Bitcoin Halving 2024 is changing the way that supply and demand are set. If there are fewer new bitcoins created, then the amount available in circulation is reduced.

Thus it can lead to price rises for instance, if consumers want similar quantities as before or even more. The price has jumped significantly in BTC after each of these events throughout its history.

For example, after the halving in mid-2016, Bitcoin’s price went from about $650 to almost $20,000 by the end of 2017.

Similarly, post-2020 halving, Bitcoin reached an all-time high in April 2021 with approximately $64,000 in value at that time. For more insights into this trend, read this CoinDesk analysis.

Network Security and Miner Earnings

Miners are also directly affected by the decline in block rewards. Miners with high electricity bills or less efficient hardware can no longer continue operation at a profit, hence they are not able to mine those coins.

If this trend were to continue for long, then it may result in a temporary drop in the total hash rate of the Bitcoin network, which indicates how much processing is done by this cryptocurrency.

However, historically, the Bitcoin network has always bounced back and eventually returned to its previous levels of hash rate as investments return to the market.

Check out the current hash rate trends on Blockchain.com

Despite short-term potential disruptions, Bitcoin halving events are fundamental to its long-term security. With fewer new bitcoins being created, the existing ones become rarer and more valuable, serving as a store of value.

Miners will be motivated to continue securing the network, even with lower block rewards, due to the increased value of transaction fees and existing holdings.

Investor Behavior and Market Sentiment

The Bitcoin halving event of 2024, for instance, always draws huge media attention and attracts a lot of speculation. The prospect of Bitcoin Halving 2024 is expected to generate activity among retail and institutional investors.

Historically, these occurrences have favored Bitcoin prices as people invest their money hoping for a future uplift in value.

Short-Term Volatility

However, one should take into consideration that the time right before and after a halving event may be characterized by high volatility.

Different market participants could have different opinions about the specific halving effects causing price changes due to variations in market sentiment.

For instance, some investors may take profits, causing short-term corrections, while others could predict a rise in prices.

Long-Term Expansion

While there may be a lot of fluctuations over a short period, long-term predictions appear to be favorable for Bitcoin after halving events.

This is mainly because Bitcoin’s long-term growth potential is influenced by its increasing limitedness and continuous acceptance as a store of value and means of trade worldwide.

As a result, more institutional investors, such as hedge funds and publicly listed companies, might join in, helping to strengthen and mature the cryptocurrency ecosystem.

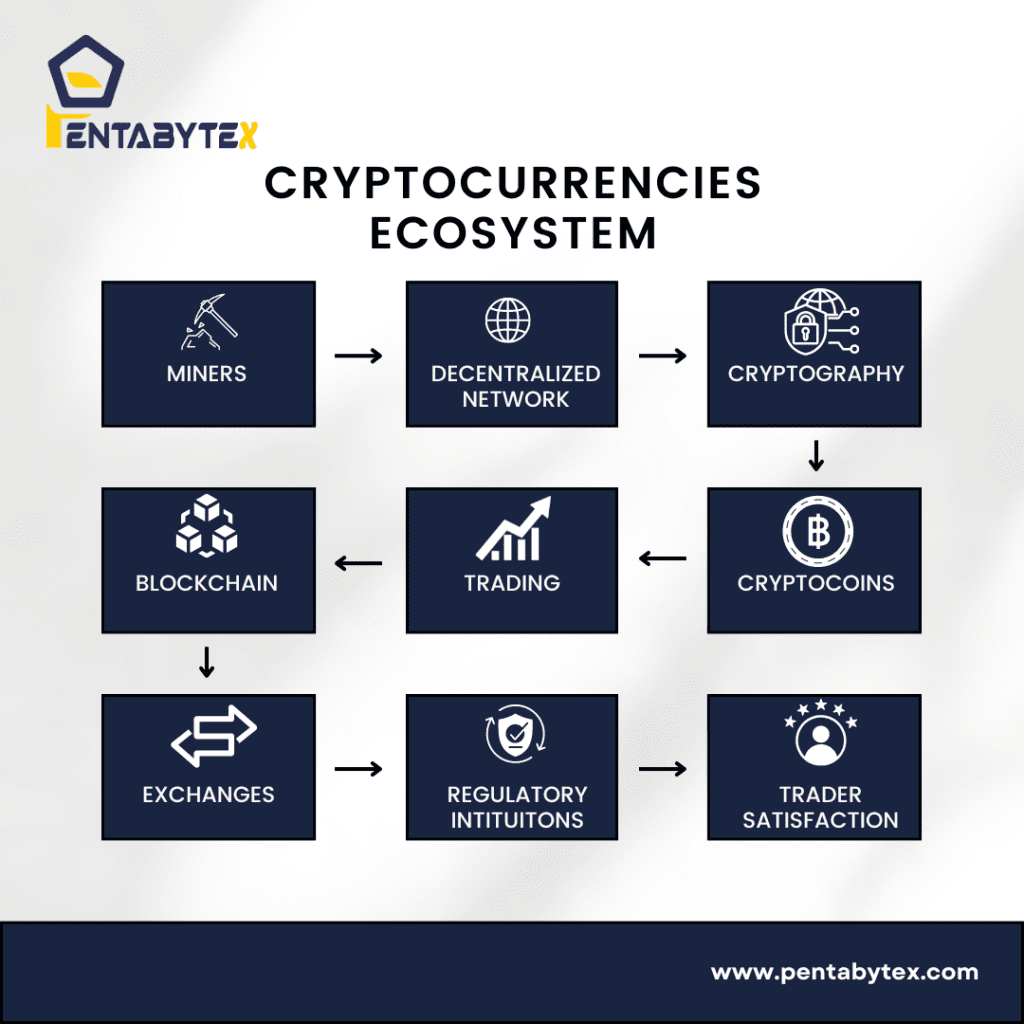

The Broader Crypto Currency Ecosystem

The halving occasions for Bitcoin also set off chain reactions in the entire cryptocurrency industry. Being the most popular virtual currency, trends in this area are usually initiated by Bitcoin.

Therefore, if there is any positivity on Bitcoin, it will probably spread to other cryptocurrencies known as altcoins.

Altcoin Performance

Now that Bitcoin Halving 2024 is on the cards, many investors will be searching for other ways to invest in cryptocurrencies.

This may result in an increase in interest in altcoins, which could increase their price and encourage further industry innovation and development.

However, investors must research to fully understand the risks and special value propositions that come with each cryptocurrency.

For a list of top altcoins, visit Investopedia.

Adoption and Innovation

The hope for upcoming halving instances and their outcomes may lead to innovation and taking up risks in the cryptocurrency business.

Entrepreneurs and developers might come up with new ideas, and techniques, to add value to digital money to benefit from its increased popularity.

Ultimately, such constant motion of inventiveness would facilitate progress in different fields like banking systems, trading logistics, or medical services using blockchain technology.

To learn how to use digital marketing trends to boost these innovations, read our comprehensive guide on Digital Marketing Trends.

Preparing for Bitcoin Halving 2024

As the cryptocurrency community prepares for Bitcoin Halving 2024, investors, miners, and fans need to stay informed and make strategic decisions.

Here are some ways to cope with this critical occurrence:

- Educate Yourself: Understand the mechanics behind Bitcoin halving and its possible consequences for the market. Stay updated with news and analyses from trustworthy sources.

- Widen Investments: Bitcoin is an important player so having a diverse investment portfolio helps reduce risks and take advantage of opportunities in the broader cryptocurrency market.

- Monitor Market Trends: Keep an eye on market trends as well as what investors perceive just before the halving. Be ready for price swings that could occur suddenly and based on your risk tolerance investment goals.

- Stay Patient: Prices tend to fluctuate wildly in the crypto-currency business especially when there are crucial happenings like halving. So, have a long-term view instead of making hasty decisions based on high and low prices within a day.

To learn more about crafting effective strategies in uncertain markets, check out our article on Social Media Strategy Tips.

Conclusion

Bitcoin Halving 2024 is one of the most important events in the entire cryptocurrency history. This event slows the creation of new bitcoins. This reduction ensures the continuing scarcity of Bitcoin. As a result, the value of existing bitcoins may increase.

There may be volatility right after the halving. However, Bitcoin and other cryptocurrencies are set for greatness. Thus, staying on top of things shall entail necessary strategy-making and other smart moves. So as not to struggle with upcoming digital asset trends.

Cryptocurrency enthusiasts and investors can prepare to profit from ongoing developments and innovations. Stay informed about the impact of Bitcoin halving and making suitable plans.

Bitcoin Halving 2024 isn’t just a technical detail; it highlights how decentralized digital currencies have survived every challenging moment. For insights into how AI is transforming SEO marketing, check out our detailed article on SEO marketing and AI transformation.